Identity Theft Ranking of Corporate America

Consumers really have no reliable way to determine

the relative safety of their business and banking

relationships against identity theft. With the lack

of widely available public information available,

the average citizen faces a diminished ability to

discern which institutions are actively competing

to protect you from identity theft.

That is until just now.

According to a recent story published by the

New York Times based on an original paper

published by consumer advocate Chris Hoofnagle,

"... some institutions have a far greater

incidence of identity theft than others."

You might recall, as we had previously reported,

that until 2005 there really was no nationally

binding law which required companies to disclose

identity theft or major security breach incidents

to the general public.

For years, private banks and businesses could

keep the magnitude and frequency of fraudulent

account activity hidden from the public at large.

Big banks and other businesses would rather

keep you uninformed of those losses suffered

by millions of account holders nationwide.

Instead of funding more proactive ways to

combat fraud and identity theft, the general

trend was to pour more money into advertising

and brand promotion as means to simply over

power any negative perceptions associated with

incidents that became too large for segments of

the population and the mass media to ignore.

However, in 2005 everything changed with the

landmark legislation requiring companies to

publicly disclose within 30 days incidents of

security breaches negatively impacting

consumer information.

Since that time, over 125 million Americans

have been the innocent victims of unauthorized

exposure of their sensitive consumer information

such as social security numbers, credit information,

etc.

Now let's roll the calendar forward to current day

2008.

While some industry trade research has indicated

identity theft to be on the decline, the official

government watchdog's statistics paint a different

picture:

The Federal Trade Commission reported last

month that calls about identity theft to

its consumer complaint hotline constituted

36 percent of all calls last year — little changed

from 37 percent in 2005 according to the New

York Times.

The banking industry tends to believe there

has already been enough disclosure, however:

Doug Johnson, a senior policy adviser at

the American Bankers Association, an

industry trade group, said that revealing

internal bank data on identity theft would

not do much to help fight the problem.

He said that it might actually distract

financial institutions, which now privately

share information among themselves and

collaborate to fashion antifraud techniques.

So, our tip for today is for you to be the

judge of where to conduct financial related

business based on safety to account holders.

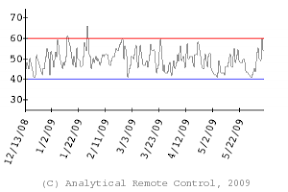

Take a look at the chart as well as the original

full report by Mr. Hoofnagle and decide on your

own.

We simply, in this case, provide the access to

you being a more informed consumer in fighting

back against identity theft and consumer fraud.

PS: Make sure to tell a friend or associate about

this identity theft prevention tip.