7 Unlucky Signs of Identity Theft

"People whose identities have been stolen can spend months or years

and thousands of dollars cleaning up the mess the identity thieves

have made of their good name and credit record.” – F.T.C.

Here's 7 ways to detect if you're an are well on your way to

joining the 10 million other identity theft victims of last year and

what you can do to prevent these mistakes from happening

to:

1) Failing to receive bills or other monthly financial

statements via USPS mail which means an identity thief

has changed your address.

2) Receiving credit cards or account statements that you

did not apply for.

3) A lender tries to repossess a car you didn't

even know you owned.

4) Being contacted by the police for a crime

committed in your name.

5) Getting denied for a loan for no apparent reason

when you thought your credit rating was excellent.

6) Receiving calls and letters from debt collectors or

businesses for merchandise or services you did not

buy.

7) Sudden, unexplained charges or withdrawals from

your financial accounts - especially credit cards.

What can you do to prevent these signs of identity

theft from happening to you?

One way is to frequently monitor your accounts on-line

since identity theft is commonly a crime committed

against unknowing consumers who are simply too busy with

the everyday pace of work and family life. Coupled with

the traditionally slow monthly financial statement mailing

cycle, an identity thief can wreck your credit and good name

faster than you can detect authorized activity.

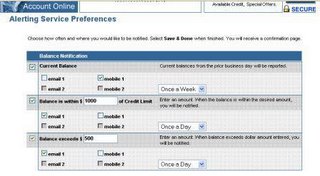

That is....unless you utilize a non-manual review and

exception signaling process like the graphic below

illustrates for a bank or credit card provider.

So, our tip for today is to enroll for automatic fraud monitoring

on all the balances of your financial accounts especially looking

for unexplained charges or withdrawals. Go further and

select the options to recieve weekly or even daily

"alerts" for when an identity thief's unauthorized

purchases "trigger" large out of pattern balance

changes which can be caught as depicted above.

Please remember, simple prevention steps can save you from the

overwhelming frustration and considerable expense of

attempting to reverse the damages of identity theft

after it has happened to you and your family members.

0 Comments:

Post a Comment

<< Home