Ameriquest Mortgage Exposes Credit Reports and SSN to Identity Thieves

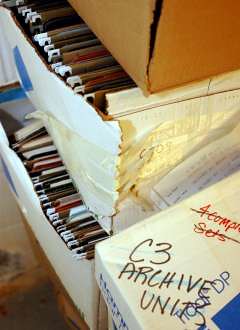

With this summer's melt down of the sub-prime mortgage

industry, Ameriquest was found to have dumped 40 boxes

worth of their customer's highly confidential credit information

into the trash dumpsters near a Atlanta area apartment complex.

For would be identity thieves, it just doesn't get any easier than

this example to steal the identities of a countless number of

unsuspecting victims.

According to the Wall Street Journal this mortgage industry

problem could be much worse than suspected when similar

incidents have been reported in Hawaii and Indiana:

"Over three days, he peered into 40 Dumpsters behind

loan branches and title companies that handle mortgage

documents.

In nearly half -- 18 -- he discovered sensitive information

about borrowers."

You could see their complete financial lives on paper,

dating back 20, 30, 40 years," he said. Among the finds

inside the mortgage files: a letter from one borrower's

counselor saying he was doing well in alcohol rehab."

Fortunately, though, at least in the Atlanta case a good samaritan

retrieved all of the boxes and turned them over to local police for

safekeeping.

So, our tip for today is to assume that most companies,

especially those going through financial distress and

employee turnover, are prime suspects to loose your

confidential personal data.

Arm yourself by enrolling in credit monitoring as well

as to get your non-credit (but publicly available) personal

data secured.

Because, you never may know who can easily retrieve

your credit records or social security number (ssn) from

the trash someplace and ruin your financial future.

3 Comments:

For an identity thief to get a full credit report including social security numbers (ssn), date of birth, address, & phone is worth thouands of dollars each.

Adding insult to injury, those boxes contained mortgage application data which is even more extensive than typically for credit cards.

Why wouldn't the parent company not be held liable for a local office's shoddy handling of sensitive consumer data?

That's just great - first mortgage companies like Ameriquest rip us off with loan shark rates on our mortgages.

Then when they get caught with all of those defaulted loans, they simply close down their offices and move on.

Meanwhile, after all of the profits have been siphoned off of us consumers, they just throw our credit information in the trash like yesterday's rotten garbage.

Is it any wonder why identity thieves are making a killing off of the likes of the mortgage industry?

Someone ought to investigate this further.

This makes me so angry.

How bout this Agent 99, they make the CEO of Ameriquest go down to Atlanta and personally have to apologize to all of their customers whose data they were neglible in the disposal of

their personal data.

Even better still, have a local TV news crew there to film the public apology so as to make an example of these company CEO's who gladly enjoy the profits but don't spend the money to protect the data their customers provide and entrust them with.

Post a Comment

<< Home