Identity Theft Victim's Quick Reaction Saves $755,000 Retirement Fund

A quick reaction by an identity theft victim saves her entire

retirement account after it mysteriously disappears.

$755,000 would have been spent entirely or

become completely untraceable to any recovery

attempts by law enforcement, had it not been

quickly discovered by the victim, a woman residing

in Delaware.

The woman called police immediately upon discovering the theft.

The resulting fraud investigation uncovered the money had been

transferred electronically to a phony account that was created

within the online stock-trading service, E*Trade Financial.

As a result of the quick reaction by the identity theft victim

and law enforcement, the entire $755,000 was recovered.

The woman was not sure how her account was accessed as

investigators are continuing with the search through internet

service provider records.

The good news, here, is the identity theft victim did

several things right which we advocate as part of your

prevention strategy:

- Frequent monitoring on-line of your financial accounts

- Scrutinizing your balances and especially withdrawal transactions

- Not hesitating to contact proper authorities when suspicious

activity is discovered

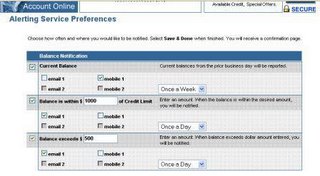

"burglar alarm" on all of your banking and credit profiles

to constantly monitor for irregular activity to alert you

via your favorite wireless or email device. Also, make

sure to check your public records quarterly for any

non-credit report data items which are just as harmful

to your reputation if an identity thief has generated

false arrests or bankruptcies in your name.